房产投资美国绿卡 Real Estate Immigration Investment

Oct. 2018, Supported Forbes Under 30 Young Entrepreneurs in 2018 Summit.

2018年10月, 支持福布斯2018年轻企业家高峰会议

John Kerry – an American former Secretary of State and former Senator from MA at 2018 Summit.约翰克里 – 美国前国务卿前参议员在峰会上

。

Adam Rippon – an American figure skater in the Summit.

美国著名花样滑冰运动员亚当‧里彭 Adam Rippon在峰会上。

Patty Chen at 2018 Forbes Summit 陈艺平在福布斯2018年轻企业家峰会上

Sep. 2018, Participated INBOUND Conference 2018 at Boston

2018年9月, 参加在波士顿举行 INBOUND2018会议

INBOUND Conference is a community of people who are passionate about marketing, selling, and delighting customers. It is an annual event and year-round media platform. INBOUND is hosted by HubSpot to bring together a community of industry professionals that come together to learn, get inspired, and grow better together.

INBOUND会议是一个热衷于营销,销售和让客户满意的会议是一个年度活动和全年的媒体平台。 INBOUND由HubSpot主持,汇集了一群行业专业人士,他们聚集在一起学习,获得灵感,共同成长。

Troy Carter is the founder and CEO of Atom Factory and co-founder and Managing Partner of Cross Culture Ventures. He serves at Spotify as its Global Head of Creator for relationships with artists, producers, songwriters and record companies. He managed the careers of John Legend, Lady Gaga…

Keynote speaker Deepak Chopra, an internationally acclaimed author and innovator, is the best known for his advocacy of alternative medicine and personal transformation.

Brian Halligan Co-Founder & CEO of HubSpot, to help businesses transform the way they attract and engage customers. He is a Senior Lecturer at MIT where he teaches 15.S16 Entrepreneurial Product Development and Marketing.

July 2018, Forwarding Current Real Estate News: Signals of a slowing market?

2018年7月, 转载目前美国房地产新闻,那是市场放缓的信号?

Manhattan real estate continues to slide

CNBC’s Robert Frank reports on how New York City real estate fared in the second quarter of 2018

Manhattan real estate has worst second quarter since financial crisis

In Seattle real estate market, inventory is finally up

May 2018, Big Banks Are Backing Away From Commercial Real Estate

2018年5月, 大银行正在远离商业房地产

(传载 )

https://www.bisnow.com/national/news/capital-markets/big-banks-wary-of-cre-pricing-tighten-lending-87595

Commercial real estate lending increased by $26.4B in Q1, but research shows the nation’s largest 25 institutions are beginning to back away from the market…

一季度商业房地产贷款增加264亿美元,但研究表明,全美最大的25家机构正开始退出市场….

Dec. 2017, Slow And Steady Growth: 2018 Performance Forecast For Top 4 Commercial Real Estate Sectors

2017年12月,缓慢稳定增长:2018年前四名商业地产部门业绩预测

(传载 )

https://www.forbes.com/sites/bisnow/2018/01/09/slow-and-steady-growth-2018-performance-forecast-for-top-4-commercial-real-estate-sectors/#51dcb02a42db

Following one of the longest economic expansions in U.S. history, Colliers International economists forecast 2017 was the year of the market’s peak.

There are several factors that indicate the cycle’s best years are in the past, Colliers International Chief Economist Andrew Nelson wrote in the company’s 2018 Outlook report, including slowing deal volume, eight consecutive months of declining commercial property prices, plateaued cap rates, a widening divide between seller asking prices and buyer bids and investors going in search of riskier assets for better returns.

Though the cycle is getting long in the tooth, the industry is expected to continue riding the waves of the strong economy to steady growth, albeit at a more moderate pace than years past.

高力国际(Colliers International)经济学家预计,在美国历史上经济规模最大的一次扩张之后,2017年是市场高峰的一年。

高力国际首席经济学家安德鲁•纳尔逊(Andrew Nelson)在该公司的2018年展望报告中写道,有几个因素可以说明这个周期最好的年份过去了,包括交易量下降,商业房地产价格连续八个月下滑,上限利率上涨, 卖方询问价格和买方出价,以及投资者为了获得更好的回报而寻找风险较高的资产。

尽管周期日益加长,预计行业仍将继续保持强劲的经济平稳增长势态,速度比过去较缓慢。

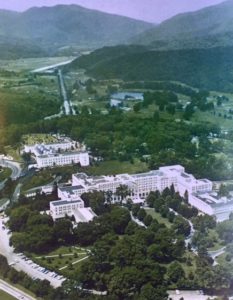

Oct. 2017, The Future of Cities in Worldwide at Harvard Business School and Harvard Graduate School of Design

2017年10月,全球城市的未来

由哈佛商学院和哈佛大学设计研究院联合主办的讨论会。

未来的城市会是什么样子?当代城市化挑战将如何为下一代创新奠定基础?谁来引导投资和制度安排,解决蔓延,气候变化,社会空间不平等和技术变革等问题?该专题讨论会展示了一系列技术,基础设施和城市治理领域的专家,创新者和思想领袖。借鉴非洲,拉丁美洲,亚洲,欧洲和美国的经验,将就如何最好地解决以下事实分享他们的观点:至2050年,预计全世界70%以上的人口将居住在城市来自亚洲和非洲的近90%的增长。辩论将围绕强化的城市增长对城市定义的基本政治,经济和社会安排的影响以及新技术和基础设施在改变城市足迹和生活质量方面的作用。

Patty Chen with Harriet Tregoning – former deputy assistant secretary of HUD. 美国住房和城市发展部计划和发展办公室前副助理秘书 Harriet Tregoning

Patty Chen with Harriet Tregoning – former deputy assistant secretary of HUD. 美国住房和城市发展部计划和发展办公室前副助理秘书 Harriet Tregoning

Harvard University President Drew Faust at the conversation about the future of cities. 哈佛大学校长Drew Faust Left: Mohsen Mostafavi-Dean of Harvard Graduate School of Design. Right: Diane Davis-Chair at DUPD of Harvard Graduate School of Design. L:哈佛大学设计学院院长Mohsen Mostafavi; R: 哈佛大学设计学院城市设计系主席Diane Davis

Left: Mohsen Mostafavi-Dean of Harvard Graduate School of Design. Right: Diane Davis-Chair at DUPD of Harvard Graduate School of Design. L:哈佛大学设计学院院长Mohsen Mostafavi; R: 哈佛大学设计学院城市设计系主席Diane Davis

Aug. 2017, Chinese Overseas Real Estate Buying Spree Slows by China’s Currency Caps

2017年8月, 海外房地产买卖因中国外汇货币限制涨势跌

(传载 )

https://www.forbes.com

The U.S. is the most popular destination for Chinese immigrants, students and corporate investment, which drives investment in property. Tighter capital controls and a slowing domesticChinese economy are making it harder for Chinese to buy property overseas. The Chinese middle class, both in China and in the United States, stands to lose the most by China’s newly imposed currency restrictions. The group most affected may be the many Chinese buyers who already live and work in the United States and rely on money from China to purchase a home.

美国是中国移民,学生和企业投资最受欢迎的旅游目的地,及推动物业投资。 资本管制,和国内经济放缓,使得中国人在海外购买房产变得更难。中国的中产阶级在中国和美国,都受到中国新实施的货币限制损失最大。 最受影响的群体可能是许多在美国生活和工作的中国买家并且依靠中国的钱购买家庭的群体。

June 2017, Harvard University is the Place for Training Happy Citizen Leaders

2017年6月, 哈佛大学-培养快乐公民领袖之地

Patty Chen with Harvard College Dean- Rakesh Khurana 陈艺平与 哈佛大学本科学院院长Rakesh Khurana

With Harvard University Admissions Dean – William Fitzsimmons 与哈佛大学招生院长William Fitzsimmons

with Harvard Medical School professor -Sanjiv Chopra at his Happiness Seminar 与哈佛医学院教授 Sanjiv Chopra在他的幸福研讨会上.

April 2017, Harvard China Forum 2017-Sharing the Road Ahead

Featured over 100 speakers including Hank Paulson, Stephen Orlins, Lei Jun, Mark Cuban, Arianna Huffington, Pan Shiyi, Guo Guangchang, Cho Tak Wong, Yan Geling and 800 attendees participanted in stimulating dialogues on opportunities and challenges facing US and China.

2017年4月, 哈佛中国论坛 2017- 共享未来之路

超过100位演讲嘉宾,包括汉克·保尔森,斯蒂芬·奥林斯,雷军,马克·库班,阿里安娜·赫芬顿, 潘石屹, 郭广昌, 曹德旺, 严歌苓 等与800位参加者对美国和中国的机遇与挑战对话。

Patty Chen with Author and Scriptwriter at HCF 2017 陈艺平与作家严歌苓

Sep. 2016, Chinese Real Estate Buyers Are Shifting Preferences

2016年9月, 中国房地产需求者正在改变选项

Over the past few years Chinese investors have targeted major coastal cities such as San Francisco and New York City, but an article in Housingwire.com highlights a change in preferences due to these markets failing to produce significant returns.

Now a second wave of investors from China has begun to alter their investment strategy. Thanks to greater access to information and data, these investors have discovered that assets with higher yields are to be found well away from these major cities. Originally, these primary and often prestigious markets had been targeted because they were often familiar vacation destinations, or investors already had friends or family living in these areas. Foreign investors looking to purchase in the cities were after property for vacation use, or that they could leave to their children or simply as a safe haven from the Chinese economy.

July 2016, Study Finds Chinese investors have spent $300 billion on US property

Chinese investment in the U.S. real estate market has surpassed $300 billion and is growing despite China’s economic weakness and increased currency control.

2016年7月, 研究发现中国投资者已经花费$3000亿在美国房地产

转载CNBC

May 2016, New study says Chinese buyers will spend $218 billion despite Beijing’s attempts to control capital outflows.

Chinese U.S. Real Estate Demand Tip of the Iceberg

ByABBY SCHULTZ in BARRON’S

http://www.barrons.com/articles/chinese-u-s-real-estate-demand-tip-of-the-iceberg-1463706667

2016年5月, 中国人对美国房地产的需求只是冰山一尖

转载巴伦周刊By ABBY SCHULTZ

Patty Chen with Ian Schrager

Patty Chen with Ian Schrager