Patty Chen

Sep. 2016, Chinese Real Estate Buyers Are Shifting Preferences

2016年9月, 中国房地产需求者正在改变选项

Over the past few years Chinese investors have targeted major coastal cities such as San Francisco and New York City, but an article in Housingwire.com highlights a change in preferences due to these markets failing to produce significant returns.

Now a second wave of investors from China has begun to alter their investment strategy. Thanks to greater access to information and data, these investors have discovered that assets with higher yields are to be found well away from these major cities. Originally, these primary and often prestigious markets had been targeted because they were often familiar vacation destinations, or investors already had friends or family living in these areas. Foreign investors looking to purchase in the cities were after property for vacation use, or that they could leave to their children or simply as a safe haven from the Chinese economy.

July 2016, Study Finds Chinese investors have spent $300 billion on US property

Chinese investment in the U.S. real estate market has surpassed $300 billion and is growing despite China’s economic weakness and increased currency control.

2016年7月, 研究发现中国投资者已经花费$3000亿在美国房地产

转载CNBC

May 2016, New study says Chinese buyers will spend $218 billion despite Beijing’s attempts to control capital outflows.

Chinese U.S. Real Estate Demand Tip of the Iceberg

ByABBY SCHULTZ in BARRON’S

http://www.barrons.com/articles/chinese-u-s-real-estate-demand-tip-of-the-iceberg-1463706667

2016年5月, 中国人对美国房地产的需求只是冰山一尖

转载巴伦周刊By ABBY SCHULTZ

Feb. 2016, For the 7th Year, We will Help Chinese Students to Attend Boston’s Tufts University 2016 Summer School

2016年2月, 波士頓欢迎中国学生赴美国著名大学预科大学生夏季班

-第7届面向中国大陆学生的美国著名大学2016暑期班

https://pattycproperty.com/programs/index.php

office@pattycproperty.com. 网址: www.pattycproperty.com

美国电话: 781-559-0564 从中国免费直拨美国: 950-40378774

让中国学生在美国名牌大学校园里上英语暑期班,让中国学生有机会和美国学生在一起开口讲流利地英语 是我们的荣幸.由在美国波士顿的Tufts University (塔夫茨大学)和美国美亚商旅集团-波士顿分社 (AABT-波士顿)https://www.pattycproperty.com/form/ (合作主办第7届),具有面向中国学生独特风格的 年英语暑期班正在招生。

| 所列费用包含美国境内:申请费,学费,书和材料费,资料办理费, 食宿费,结业证书, 以及各项课程活动和旅游观光费等(不包括: 行李超重费,个人消费)。若申请者需要有关旅行安排事宜方面的帮助,我公司将提供协助并收取合理的费用。注:费用将等于或低于市场价。与此同时,如果组团超过25人,可有一名工作人员和学生一起赴美, 工作人员的食宿和波士顿观光费用将获全免。 |

| English Summer School for Chinese Students at Tufts University Campus |

|

| Contact: E-mail: office@pattycproperty.com |

| USA Phone: 781-559-0564 , from China Toll Free to USA: 950-40378774 |

Augest 26th. 2015, The Boston Globe Interviewed Patty Chen on how Chinese economic turmoil could boost Boston real estate

https://www.bostonglobe.com/business/2015/08/25/chinese-turmoil-could-boost-boston-real-estate-for-now/Fm9d7LUBtwcusH7Z34t9YM/story.html

2015 年8月26日《波士顿环球报》再次报道陈艺平, 有关中国的股市动荡现在可能会提振波士顿地产. 作为其市场下滑,其经济走弱,而人民币汇率下降,许多人想知道,如果波士顿的房地产市场将受到影响 – 但短期内它可能会获利.

As its markets slide, its economy weakens, and its currency declines, many wonder if Boston’s real estate market will suffer — but short-term, it may gain.

July 9th. 2015, The Nikkei Asian Review Interviewed and Reported on Patty Chen and PattyC Property Group

2015 年7月9日, 《日本経済新聞社》采访报道了总裁陈艺平(Patty Chen) 和本公司派蒂克房地产集团帮助中国新移民在美国购房和安居

Asian immigrants changing US economy, society

HIROYUKI KOTAKE, Nikkei Washington bureau chief

There have been four waves of immigration to the U.S.: 1) Native Americans; 2) immigrants from Western and Northern Europe and slaves from Africa from the 16th century to the 19th century; 3) immigrants from Southern and Eastern Europe, the Middle East and the Caribbean in the 19th and 20th centuries; and 4) immigrants from Latin America and Asia after World War II.

The fourth wave has accelerated since 1965. President Lyndon Johnson eased restrictions on the number of immigrants to be accepted from each country, and as a result the number of immigrants from Latin America and Asia, which had been suppressed under stricter limits than those on people from Europe, started rising sharply. Their fertility rates are also generally high, which is helping drive the steady expansion of the U.S. population.

The lead player in the fourth wave is about to shift from Latinos to Asians. In 2013, the U.S. accepted a total of more than 1.2 million immigrants. The top spots were dominated by Asian countries, with 147,000 people from China and 129,000 from India, exceeding the 125,000 from Mexico. Immigrants from South Korea and the Philippines have also kept climbing. The recent trend underscores the fact that Asia, a region with a diverse mix of countries and huge populations, is gaining greater presence in the U.S.

Furthermore, diligent Asians earn high incomes and achieve high education. Statistics in 2013 showed that their median household income was $72,000 and people aged 25 or older who have a bachelor’s degree or higher stood at 51%, considerably higher than the U.S. national average of $52,000 and 30%. This is another reason that Asians are increasing their presence in the country.

Patty Chen runs a real estate company in the suburbs of Boston, Massachusetts. “We not only arrange contracts to buy a house; we support many things, such as kids, fixing up a house and finding shops. They come to us for support.” She said she has received requests from Chinese clients looking to buy houses for cash. These customers hope to immigrate to the U.S. for their children’s education or to protect their assets, even though they may not be fluent in English.

According to the Selig Center for Economic Growth at the University of Georgia, the purchasing power of Asians in the U.S. totaled $770 billion as of 2014 — 19th in the world if compared with gross domestic product data — larger than Saudi Arabia and Switzerland. One estimate by Selig showed that their purchasing power will continue to expand and top $1 trillion in 2019. The increase in the number of Asians, who are relatively young and wealthy, might serve as a tailwind for the U.S. economy, which has been struggling with the aftereffects of the financial crisis and its aging population.

A huge crowd cheers Indian Prime Minister Narendra Modi at Madison Square Garden in New York on Sept. 28, 2014.© Reuters

Meanwhile, the higher Asians’ economic status becomes, the bigger say they have in the country. In September 2014, about 19,000 people reportedly gathered at Madison Square Garden in New York to show their support for Indian Prime Minister Narendra Modi during his first visit to the U.S. since taking office. The Indian group that organized the event claimed it was the largest ever in the U.S. to welcome a foreign leader. MR Rangaswami, an Indian investor who participated in the event, said, “That was a big milestone event that the community can look back on and feel proud.” He is also involved in lobbying and takes as an example Jewish-Americans. By learning about their political and charity activities, he tries to boost the recognition of the Indian-American community in the U.S. as well as the national interests of India. Lobbying campaigns by Indian residents were also the driving force behind the U.S.-India Civil Nuclear Agreement, which took effect in 2008.

Louisiana Gov. Bobby Jindal formally announces his campaign for the 2016 Republican presidential nomination in Kenner, Louisiana, on June 24. © Reuters

“My dad told me as a young kid that Americans can do anything. I believed him then, and I believe it now,” said Bobby Jindal, the Republican governor of Louisiana. On June 24, he announced his candidacy for the presidential race in 2016, becoming the first Indian-American to become a major contender. Nikki Haley, the Republican governor of South Carolina and another Indian-American, is also mentioned as a vice-presidential candidate. In the not-too-distant future, an Asian American may become the most powerful person in the U.S.

Nikkei staff writers Tomoko Ashizuka, Michiko Kageyama in New York and Yuichiro Kanematsu in Silicon Valley contributed to this story.

May 17, 2015, Celebrated the 47th Annual Wellesley Veterans’ Parade and the Annual Wellesley’s Wonderful Weekend with Our Neighbor Friends

2015年5月17日,与肯尼迪家族成员和邻居朋友在公司楼前一起庆祝第47届韦尔斯利退伍军人游行和年度韦尔斯利的美好周末

http://www.wellesleyweekend.com/parade.html

March.2015, The Year of the Chinese Investor

2015年3月,中国投资者的一年

March 03, 2015 10:45AM The Real Deal

By E.B. Solomont

– See more at: http://therealdeal.com/issues_articles/the-year-of-the-chinese-investor/

For more than two decades, China’s most populated city, Shanghai, has experienced a building frenzy unlike any other: Developers have built office buildings in the city of 24 million as far as the eye can see, including skyscrapers like the under-construction Shanghai Tower, one of the tallest in the world.

But increasingly, Chinese developers and investors are looking elsewhere to build. And a fast-growing number are setting their eyes on New York.

Chinese investors pumped more than $3 billion into the New York real estate market last year. That was nearly 43 percent more than they invested in 2013. And it appears to just be the tip of the iceberg.

With China’s economy cooling, investors are throwing their money into deals in New York. And it’s not just individual Chinese buyers snapping up condo units these days. Institutional players, investors and developers, who’ve made a splash buying trophy buildings over the past two years, are not only continuing to ramp up purchases, but also are accelerating their involvement in condo development and looking for developable New York land.

“There’s a whole lot of capital in Asia that wants to be invested [here],” said Kevin Swill, chief operating officer of the New York-based Carlton Group, a real estate investment banking firm. “They look to the U.S., even with ups and downs, and it’s still the most stable real estate market in the world.” …..

Nov. 2014, New visa rules expected to boost U.S.-China tourism and investment

2014年 11月,美国对华签证新政11月12日实施

商旅10年、学生5年

The visa announcement came just after President Obama’s arrival in Beijing, where he addressed Asian business leaders at a summit of the Asia-Pacific Economic Cooperation. Under the visa agreement, business and short-term tourist visas will be valid for 10 years, while student and cultural exchange visas will last for 5 years, putting China on level footing with other major trade partners like Brazil and several European countries. Currently, such visas expire after one year. “I’ve heard from American business leaders about how valuable this step will be. And we’ve worked hard to achieve this outcome because it clearly serves the mutual interest of both of our countries,” Obama said.

中新社华盛顿11月10日消息,白宫10日表示,美方将于本月12日起实施对华新签证措施,为前往美国从事商务和旅游活动的中国公民颁发有效期最长为10年的多次入境签证,为赴美留学的中国公民颁发有效期最长为5年的多次入境签证。

美国总统奥巴马当地时间10日在北京宣布对华新签证措施,中国公民赴美商业旅游签证将延长至10年,赴美学生签证将延长至5年。中方同日表示,中美经过友好协商并本着平等互惠原则,已就互为对方商务、旅游和留学人员颁发长期多次签证达成共识,这将便利中美两国人员往来,对促进各领域交流与合作具有重要意义。

白宫在当天发布的声明中说,新的签证安排将进一步密切美中经贸、投资、商业和人文联系,美方将于2014年11月12日根据新的互惠协议发放签证。白宫同时表示,放宽美国公民赴华签证措施也有利于提振美国出口,加强两国经贸联系。

白宫说,中国目前是世界上出境旅游增长最快的国家,长期以来美国一直是中国旅客向往的目的地国,但每年仅有低于2%的中国出境旅客选择美国,其中出行成本和签证问题是最受关注的两个问题。

根据白宫发布的数据,2013年共有180万中国旅行者访问美国,为美国经济做出211亿美元贡献,帮助美国增加了10.9万个就业岗位。白宫预计,实施“有竞争力”的签证政策后,到2021年将有730万中国旅行者来到美国,为美国经济贡献850亿美元,帮助美国增加44万个就业岗位。

11月12日,美国国务卿克里在北京美国驻华使馆签证大厅,为首批获得10年有效美国签证的中国公民颁发签证。当地时间12日在华盛顿的中国驻美使馆也发出了首张10年有效期美国赴中国签证。

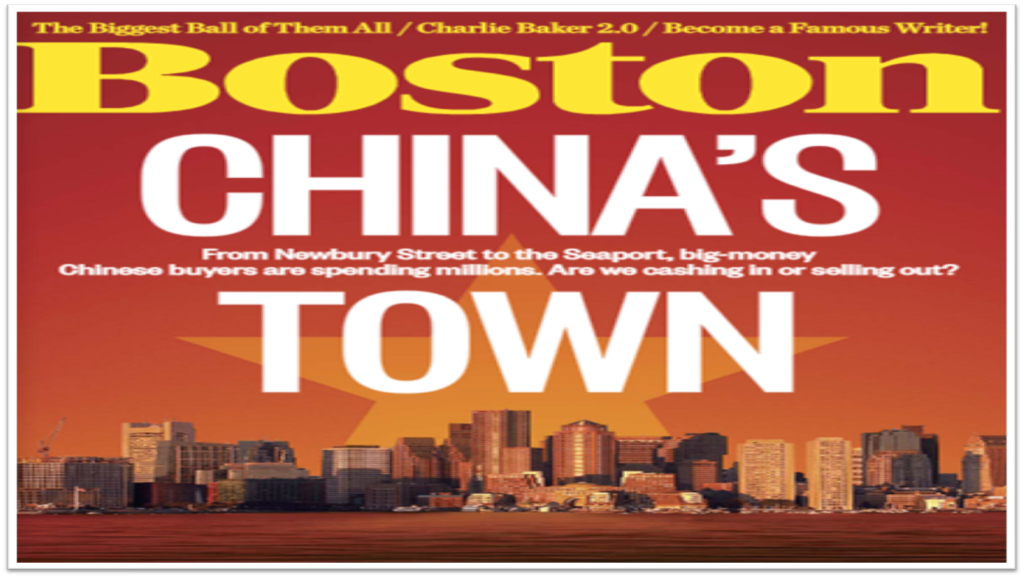

Oct. 2014, Boston Magazine Reports That Our Wellesley Based PattyC Group Has Grown Into A Full-Service Empire For Chinese Investor-Immigrants

2014年 10月, 美国《波士顿杂志》采访报道了陈艺平(Patty Chen), 称本公司派蒂克集团(PattyC Group)现已发展成为对中国投资移民者全面服务的帝国.

《波士顿杂志》2014年十月刊封面:波士顿-中国的城

Boston- China’s Town

Oct. 2014 Boston Magazine reports that: “Patty Chen, whose Wellesley-based PattyC Group has grown into a full-service empire for Chinese Investor-Immigrants.”

http://www.bostonmagazine.com/news/article/2014/09/30/chinese-real-estate-boston/2/

Aug. 2014, For the 5th year, we have helped Chinese students to Boston Tufts University 2014 Summer School

2014年 8月,本公司已经是第5年帮助中国学生来美国波士顿Tufts University 塔夫茨大学上英语暑期班; 今年的特色是三五成群同学,朋友,亲戚一起来美国; 中学生来的最多;都乘海南航空北京直飞波士顿.

Our students departed with much improved skill in English and life time friendships and experiences. The testmonials from this year’s students are as following: “It has been a good experience, and I think, in the future this will be really useful”. ” It is a lovely place to study and live in Tufts University campus. All of the people there are friendly”. ” The program is meaningful, thought-provoking, interesting , and a great place to spend the summer with all of the nice people”. ” We can learn about many different cultures in the program and make many friends”.