中国日报 http://usa.chinadaily.com.cn/epaper/2014-07/10/content_17704145.htm

网易财经 http://money.163.com/14/0710/09/A0PHTL4R00253B0H.html

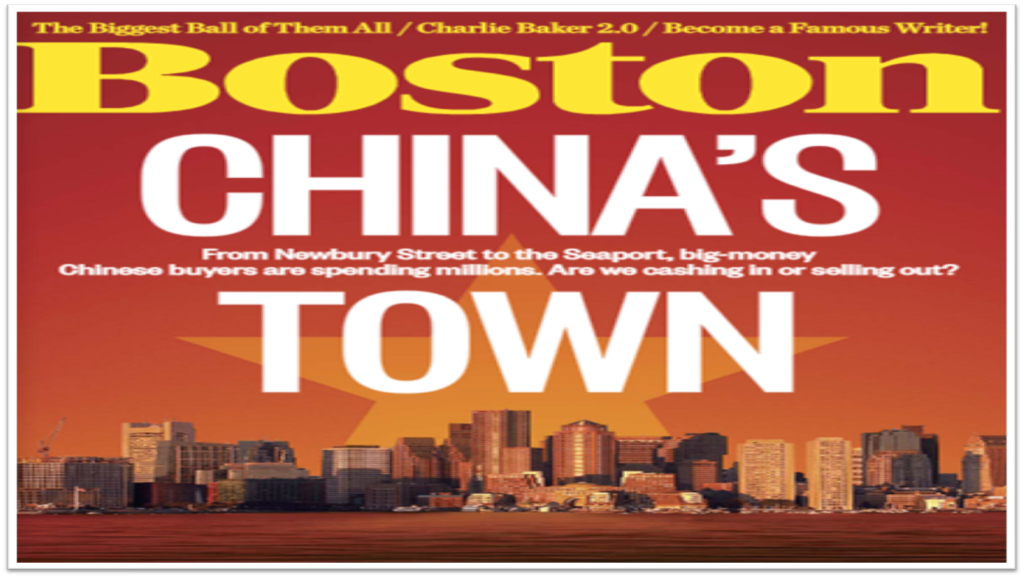

China may be the second-largest economy in the world, but when it comes to buying residential real estate in the United States, it’s No. 1.

Foreign purchases jumped to 35 percent last year, and Chinese customers led the way with $22 billion out of the $92.2 billion total spent by foreign buyers in the US real estate market, according to a report by the National Association of Realtors (NAR).

“We live in an international marketplace; so while all real estate is local, that does not mean that all property buyers are,” NAR President Steve Brown said in the report released on Tuesday.”Foreign buyers are being enticed to US real estate because of what they recognize as attractive prices, economic stability and an incredible opportunity for investment in their future.”

From April 2012-March 2013, Chinese customers spent approximately $12.8 billion in the US market, according to the NAR, and the previous year foreign buyers spent $68.2 billion on US real estate.

“The US real estate market is a relatively safe investment,” said Selma Hepp, senior economist at the California Association of Realtors (CAR). “Maybe there’s not that much confidence in the banking system in China, so the strong property rights in the US drive a lot of that demand. Also, the housing prices in the US are still affordable compared to the rest of the world,” she told China Daily on Wednesday.

The NAR said that among the hot areas for Chinese buyers are Irvine, California, and Los Angeles’ San Gabriel Valley, home to several Asian-immigrant communities.

“They’re interested in already established Chinese communities, in California and they are the predominate buyers there,” said Hepp.

International buyers are more likely to make all-cash purchases when compared to domestic buyers, she said. In 2014, nearly 60 percent of reported international transactions were all cash, compared to only one-third of domestic purchases, said the NAR.

The CAR released a survey in April that showed an increase of 8 to 9 percent of international buyers in California, with the majority being Chinese middle-aged males of high income who paid cash.

Many foreigners seek areas based on the distance from their home country, presence of relatives, climate, and education opportunities, where their children can learn English.

Hepp said that California has always been a popular market for Asian investors, especially Chinese.

Chinese buyers tend to target higher-priced markets, such as California, Washington, and New York, according to the NAR’s report.

Sofia Falleroni, an associate broker at Town Residential in New York City, told China Daily that she will close on a $6.25 million apartment sale in the city’s West Chelsea area to a Chinese buyer in January 2015.

“The New York market has been considered a stable market for the past 40 years, even with its up and downs,” said Falleroni, who said she has worked with at least10 Chinese buyers in the past year. “Buyers coming from China are looking to establish a presence in the US. New York is a place where there are a lot of opportunities, for not only real estate, but also the job market, the best education.”

Chinese buyers have been interested in the US market in recent years, ever since the 2008 financial downturn, after which they saw New York as one of the safest places to invest, said Richard Grossman, executive vice-president and managing director at New York-based Halstead Property.

“[Foreign investors] from countries with a good economy, tend to look to diversify in the US,” said Grossman. “New York is a good place for investors to put their money in because New York is one of the financial capitals of the world.”