AABT-Boston Group’s business is very broad,including real estate, education, and business travel. However, according to PattyC Property Group CEO Patty Chen, she did just one thing – providing a full range of personalized services for Chinese people staying in the United States. Due to the love of the real estate industry, Patty Chen left her job as a biological scientist to found PattyC Property Company. Due to the customer’s trust and needs, she entered the field of education. She does not consider herself doing “Business”, because what she has done are based on her passion and sense of mission.

Q: AABT has done many creative businesses: the first company to promote Chinese and American entrepreneurs’ cooperation, the first company to provide the best services in real estate investment and the field of education and so on. Why did you help more Chinese people enter the “recognize the U.S. ”market? What’s your originalintention of the company when you founded this company?

A: In fact, when we founded PattyC Property real estate investment group in 2001, the main job wasreal estate procurement and investment. In 2007, many Chinese found me and asked my help either to let their children study in the U.S., or purchase real estate- for living, orinvesting. They said that now that you provide us real estate service, can you also provide service for our children education as well? For this reason, in 2007 we founded the AABTGroup, which included real estate investment, education, and commercial tours, etc., to provide an excellent “one-stop” service for the Chinese people who stay or want to stay in the United States.

Q: Since AABT was founded in 2007, it has been five years. Did you have any cases that made you feel most proud in the past five years?

A: I think the most successful business we have done is still in real estate investment, green card, etc.related projects. While talking about this process, Thing thing that makes me the proudest is that I win many families’ trust. For example, if a Chinese family decide moving to the United States, 60% will look for about 3 or 4 service companies. After contacting us, from real estate purchase, their children’s education, or even business investment, they will only look to us for us for counseling and provision of services. Based on this trust, we do not treat this as a profitable business, but as a way to complete our mission. I have a high quality life in the United States, but as a Chinese, I also hope that other people can come here to enjoy this high quality life as I do. Chinese entrepreneurs, on the other hand, will bring money to the United States, and invest local business and other commercial activities to promote China-US economic interaction. These two areas make me feel that I am actually doing a noble thing.

Q: In terms of the Chinese students your have contacted with, which part of United States, or American Education attracts them most?

A: As far as I know, they think American education style will let them have more space to develop their own interests and potential. Unlike Chinese education, which the purpose to study is to study, not for their interests or their future like it is here in the USA.

Q: There are many student agencies that organize US travel, that include U.S. summer camp, campus visiting and other services. Compared to them, where do you think the strengths of AABT-Boston in education area?

A: I think the quality is the main differences. As far as I know, with some Chinese travel agencies one visit can bring more than 1000 people, but in their program, the children don’t get what they want. But our program will make kids reluctant to leave. We intertwine Chinese and American students in learning atmospheres and accommodations, after a while, the Chinese students can speak English with the American students! Moreover, our visit to Universities is not simply to visit the campus, but to also learn from experienced teachers how to apply to it. After the summer camp, we will issue graduation certificates to students, which is a valid certificate for them to apply for U.S. schools. Finally, it is worth mentioning that, our cost is not high, one day is less than 200 dollars, including all the costs, accommodation, transport, curricular activities fees, and insurance in the United States. This inexpensive and high quality visit/study for parents and their children is a worthwhile investment.

Q: AABT covers investment, real estate, education, business, travel, etc., in the near future, will it explore and develop all these fields or focus on a particular area? Why?

A: AABT will still emphasize on the part of the real estate investment, because this part is what we have done best. The reason we are good at it is not only because we have skills in the industry, but because we have the inner passion to do it. The company’s development must be closely linked with the positioning of the boss, the boss determines the direction of the company. Real estate is where my company and I can express out creativity the most which is why this is the part I enjoy most.

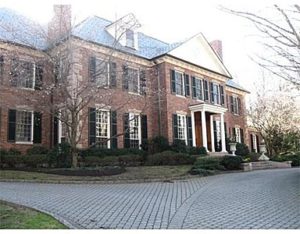

PattyC Property Group, headquartered in Boston, home to Harvard and MIT is dedicated to building a trusting and successful relationship with you. We have helped many Chinese to invest in real estate at USA. In the past 2 months we have sold 4 houses worth $7,000,000 to Chinese investors alone.

PattyC Property Group, headquartered in Boston, home to Harvard and MIT is dedicated to building a trusting and successful relationship with you. We have helped many Chinese to invest in real estate at USA. In the past 2 months we have sold 4 houses worth $7,000,000 to Chinese investors alone.